What do Florida Personal Injury Protection (PIP) policies cover?

Florida PIP coverage provides a limited amount of medical benefits, disability benefits, and death benefits for physical injury or death caused by owning, maintaining, or using a motor vehicle.

PIP covers the policy owner and relatives who live in their household. PIP policies also extend coverage to:

- Anyone driving the vehicle;

- Passengers in the vehicle; and

- Pedestrians and bicyclists the vehicle strikes.

What are the limits of Florida PIP coverage?

PIP coverage will pay up to $10,000 for medical bills and disability and $5,000 in death benefits.

Your policy will pay your bills up to the coverage limits for certain medical services, provided you seek medical care within 14 days of an accident. Those services include:

- Medical services;

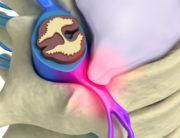

- Surgical procedures;

- Ambulance transport;

- Hospitalization;

- Nursing services;

- X-ray testing;

- Dental services; and

- Rehabilitative care.

Are all medical bills covered?

No. PIP polices only pay 80 percent of approved medical expenses up to the $10,000 limit. That limit also includes costs associated with disability.

If your insurer determines that any of the medical services you received were not medically necessary, they can refuse to pay them. The insurer can also refuse to pay medical bills that it views as excessively high.

Furthermore, any medical provider you see must hold current licenses for you to receive PIP payment. These providers may include your physician, chiropractor, dentist, physician assistant, advanced nurse practitioner, physical therapist, hospital, ambulatory surgical center, and health care clinic.

PIP will not pay for certain services, like massage or acupuncture, even if a licensed medical provider performs the procedure.

Can an insurer refuse to pay all of my medical expenses?

Yes. If you do not get your initial medical care within 14 days of the motor vehicle accident, PIP does not have to pay any of your bills. The reason behind this rule is to prevent insurance fraud by people trying to get PIP to pay for injuries or illnesses that did not occur due to a motor vehicle accident.

What lost wages and disability benefits come with PIP?

If you are unable to work because of your injuries, PIP will pay 60 percent of your lost gross income and loss of earning capacity, up to coverage limits. PIP will also pay for ordinary and necessary services you are unable to provide for your household because of the injury.

Who can receive the death benefits that come with PIP coverage in Florida?

The $5,000 in death benefits can go to:

- The deceased’s executor or administrator;

- Anyone related to the deceased by blood, marriage, or legal adoption; or

- Anyone the insurance company decides is eligible for these benefits.

Is PIP coverage mandatory?

Yes. Although the Florida House of Representatives voted to repeal PIP in April of 2017, the Senate did not vote on the measure before the end of session. As a result, PIP coverage is still mandatory. Florida’s PIP laws have been in place for 50 years, despite several previous attempts to scrap it. Insurance companies that sell motor vehicle insurance here must include PIP coverage in their policies.

The lawyers at the Montero Law Center can help you file a PIP claim.

If you or a loved suffered injuries in a crash, the car accident lawyers at the Montero Law Center can guide you through the complicated claims process. Someone is always ready to talk with you. Call us today at 954-767-6500 to line up your free consultation.

English

English  Español

Español